Sioux Valley Energy

General Manager/

Chief Executive Officer

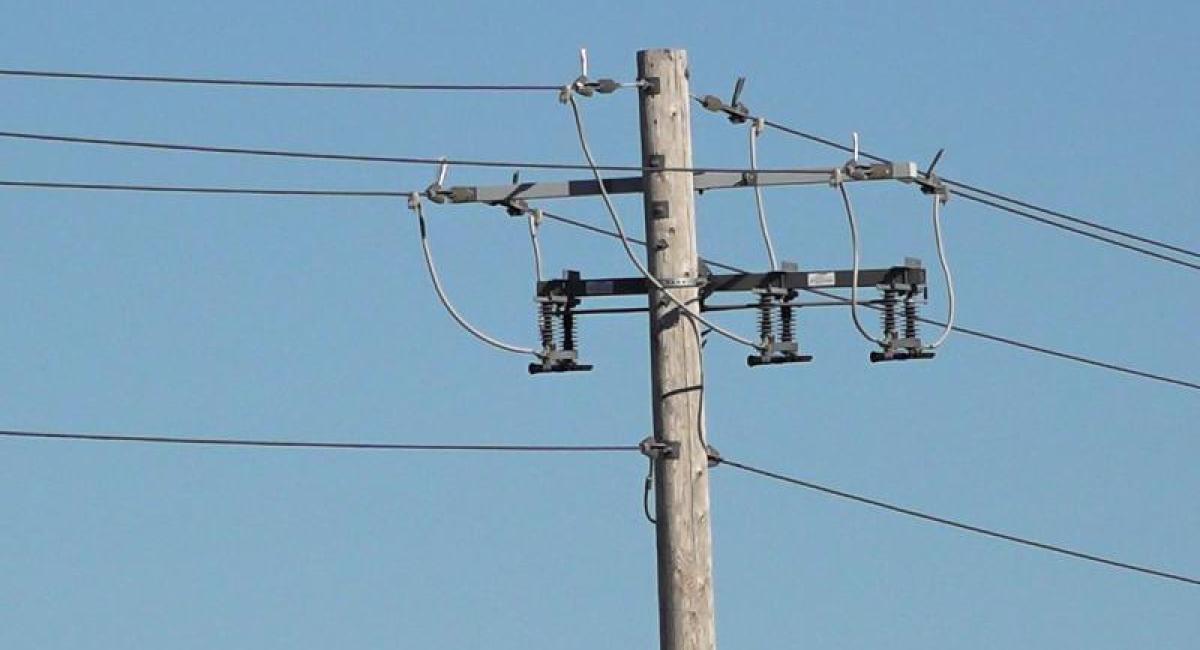

The power grid is a very complex system. The parts you see close to home such as meters, green boxes, lines, poles, etc. are just a small portion called the distribution system. There are two more levels to the electric cooperative system that ultimately helps get electricity to your home. Those two levels are transmission and generation.

Most of the transmission lines and substations you see scattered across the landscape are owned and maintained by our power suppliers East River Electric Power Cooperative and L&O Power Cooperative (L&O). That infrastructure is part of the second tier of the electric cooperative system. The third tier is the power generator. That is Basin Electric, headquartered in Bismarck North Dakota. Basin produces power at its generating facilities and that power is then transmitted through high voltage power lines to transmission lines and substations owned by East River and L&O. From there, that power is transmitted through the distribution system and voltage is “stepped down” to a level that is appropriate for your homes and businesses.

Now, that is a vast oversimplification of the system, but it gives you an idea of what it takes to get electricity from the power generator to your home or business at the end of the line. We have had significant increases in our distribution costs over the last four years or so and that has had an impact on our rates—some of that impact we were able to mitigate through cost saving measures and delay of work. However, our wholesale power supplier, Basin Electric, announced a rate increase which, as I have mentioned in my last several columns, will result in a direct pass-through to our members. In short, there will be a rate increase in 2025, and that adjustment will likely start in January with impacts on your February billing.

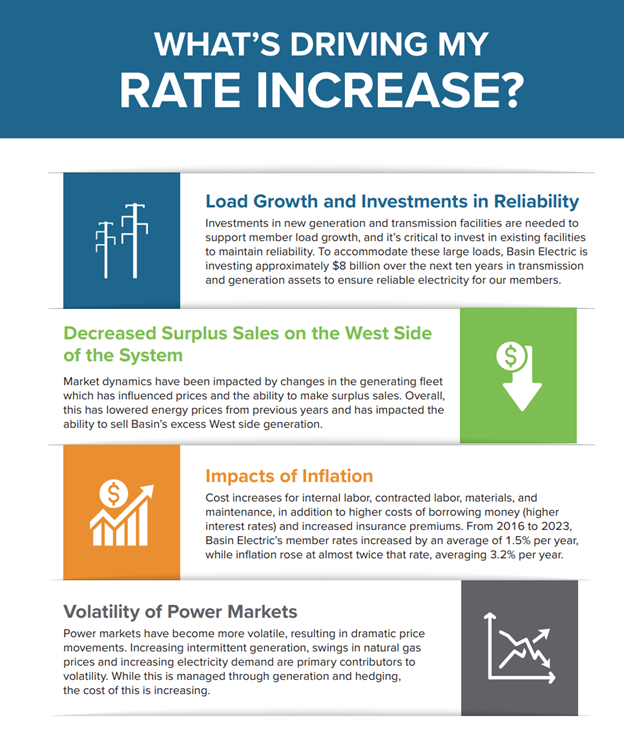

Basin’s power supply rate increase is driven by the following four factors:

Load Growth and Investments in Reliability: Basin Electric is making significant investments in new generation and transmission facilities to support member load growth across its entire system, and it’s critical to invest in existing facilities to maintain reliability. To accommodate this growth, Basin Electric is investing approximately $8 billion over the next ten years in transmission and generation assets to ensure reliable electricity for our members.

Decreased Surplus Sales in Western Markets: Market dynamics have been impacted by changes in the generating fleet in the western part of the United States. Increasing amounts of hydro and renewable energy generated in the western market are often lower priced than what our wholesale power supplier (Basin Electric) can produce it for. This limits Basin Electric’s ability to sell excess generation to the western markets.

Impacts of Inflation: There have been cost increases for internal labor, contracted labor, materials, and maintenance, in addition to higher costs of borrowing money (higher interest rates) and increased insurance premiums.

Volatility of Power Markets: Power markets have become more volatile, resulting in dramatic price movements. Increasing intermittent generation such as wind and solar, swings in natural gas prices, and increasing electricity demand are primary contributors to volatility. While this is managed through generation and hedging, the cost of this is increasing.

Here at home, Sioux Valley Energy has also been facing upward pressure on the cost of materials, equipment, labor, and financing but we hope to hold our distribution costs as steady as possible. We are still working on the details of the rate increase but hope to get that information to you soon.